washington county utah sales tax

The average cumulative sales tax rate in Washington Utah is 675. Utah has a 485 sales tax and Washington County collects an additional.

National Register Of Historic Places Listings In Utah Wikipedia

Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others.

. Sales Tax Number if items are sold. The 2018 United States Supreme Court decision in South Dakota v. Washington County Administration Building 197 East Tabernacle St George Utah Google Maps Auctions will be by open bidding wherein the full.

The minimum combined 2022 sales tax rate for Washington Utah is. Washington is located within Washington County. George UT 84770 435 634-5703.

The Washington County Treasurers office is pleased to offer a range of helpful information for the. Tom Durrant 87 North 200 East STE 201 St. The Utah state sales tax rate is currently.

The current total local sales tax rate in Washington County UT is 6450. The County sales tax. 271 rows 2022 List of Utah Local Sales Tax Rates.

Details on the qualification requirements and benefits of each program are included. Utah has state sales. 145 lower than the maximum sales tax in UT.

2020 rates included for use while preparing your income tax deduction. This sale will be located in. The County Assessor is responsible for listing and valuing all taxable real and personal property in Washington County.

See corporationsutahgov for more information. 93 rows All Utah sales and use tax returns and other sales-related tax returns must be filed. The average cumulative sales tax rate in Washington County Utah is 67 with a range that spans from 645 to 805.

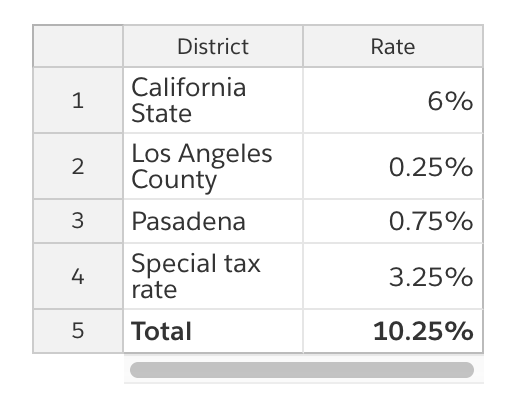

The total sales tax rate in any given location can be broken down into state county city and special district rates. This includes the rates on the state county city and special levels. The latest sales tax rate for Washington UT.

The December 2020 total local sales tax rate was also 6450. Washington County in Utah has a tax rate of 605 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in. There are many different tax relief programs available for Washington County primary property owners.

The Utah sales tax rate is currently. Average Sales Tax With Local. Washington County Sales Tax Rates for 2022.

The Washington County sales tax rate is. This is the total of state county and city sales tax rates. Provide copy of your Utah State.

The 675 sales tax rate in Washington consists of 485 Utah state sales tax 035 Washington County sales tax 1 Washington tax and. According to Sales Tax States 61 of Utahs 255 cities or. This rate includes any state county city and local sales taxes.

Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. Or the local number for the Utah State Tax Commission is 435 251-9520. This includes the rates on the state county city and special levels.

87 North 200 East STE 201.

James Allen Sales Tax Oct 2022 Find Out What You Ll Actually Pay

How Healthy Is Washington County Utah Us News Healthiest Communities

Etsy Sales Tax When And How To Collect It Sellbrite

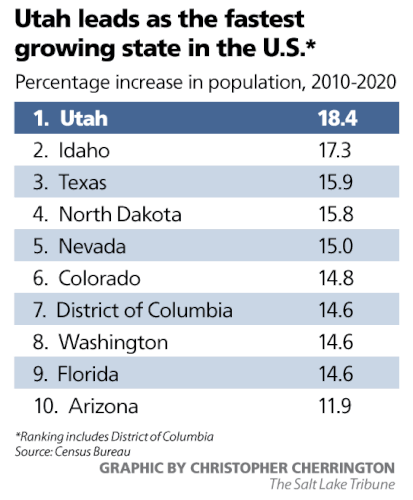

Hey California Quitters Your Future Neighbors Wish You Would Stay Home Los Angeles Times

Assessor Washington County Of Utah

Residential Property Declaration

Utah Washington County Parcels Lir Overview

Some Homeowners In Fast Growing Washington County See A Significant Property Tax Increase Kuer

Why The Second Driest State Rejects Water Conservation Propublica

Lake Powell Pipeline Utah Rivers Council

Utah Sales Tax Calculator And Local Rates 2021 Wise

The Difference Between Origin And Destination Sales Tax

New Census Numbers Reveal Utah S Staggering Growth Rate

General Sales Taxes And Gross Receipts Taxes Urban Institute

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

States With The Highest Lowest Tax Rates

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates